MASSACHUSETTS

Highly Competitive

Film Production Tax Incentives

The Massachusetts film industry has undergone substantial growth over the last decade because of its highly competitive film tax incentive package.

The tax incentives include:

A 25% credit for payroll expenses

A 25% credit for in-state production expenses

An exemption from the state sales tax on tangible personal property.

Any project that spends more than $50,000 in Massachusetts qualifies for the payroll credit. Spending more than 75% of total budget or filming at least 75% of the principal photography days in Massachusetts makes the project eligible for the production credit and a sales tax exemption.

These two features make Massachusetts attractive for Spot Production as well as Film and TV production. The streamlined program for spends of less than $250,000 allows the ability to combine the budgets of multiple spots for the same client over a 12 month period to meet the $50,000 qualifying threshold.

Program requirements are straightforward. There are no annual or project caps. No residency requirements. No extended schedule of credit payouts.

For more information, please visit theMassachusets State Film Office.

Recent Productions

Check out a few of the recent productions filmed on location at New England Studios.

The Official Bank of the NBA | Generational Ambitions

Watch Commercial

The Shade

Watch Trailer

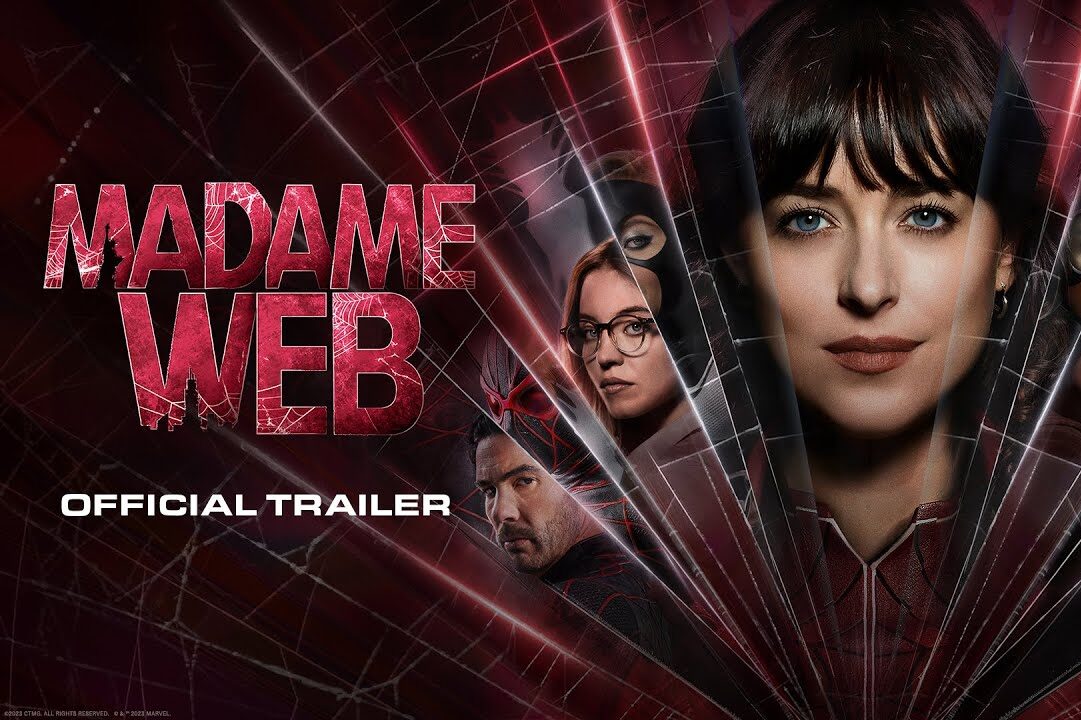

Madame Web

Watch Trailer

Pink Dreams Starring Zendaya

Watch Ad

Boston Strangler

Watch Trailer

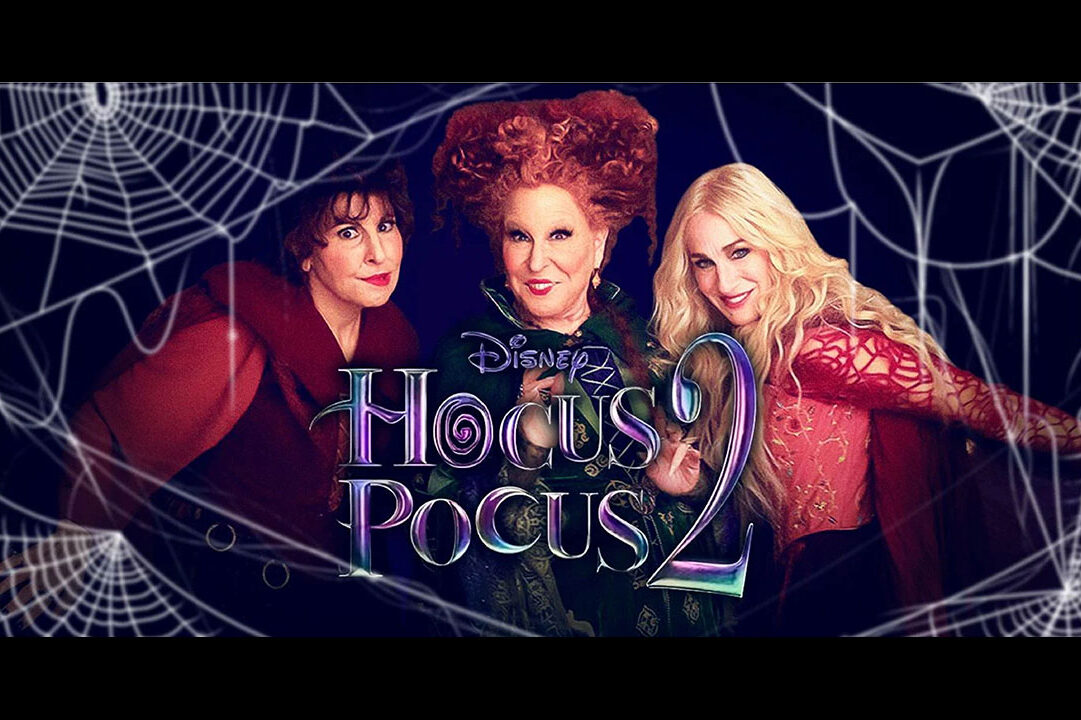

Hocus Pocus 2

Watch Trailer

Spirited

Watch Trailer

The Parenting

Learn More

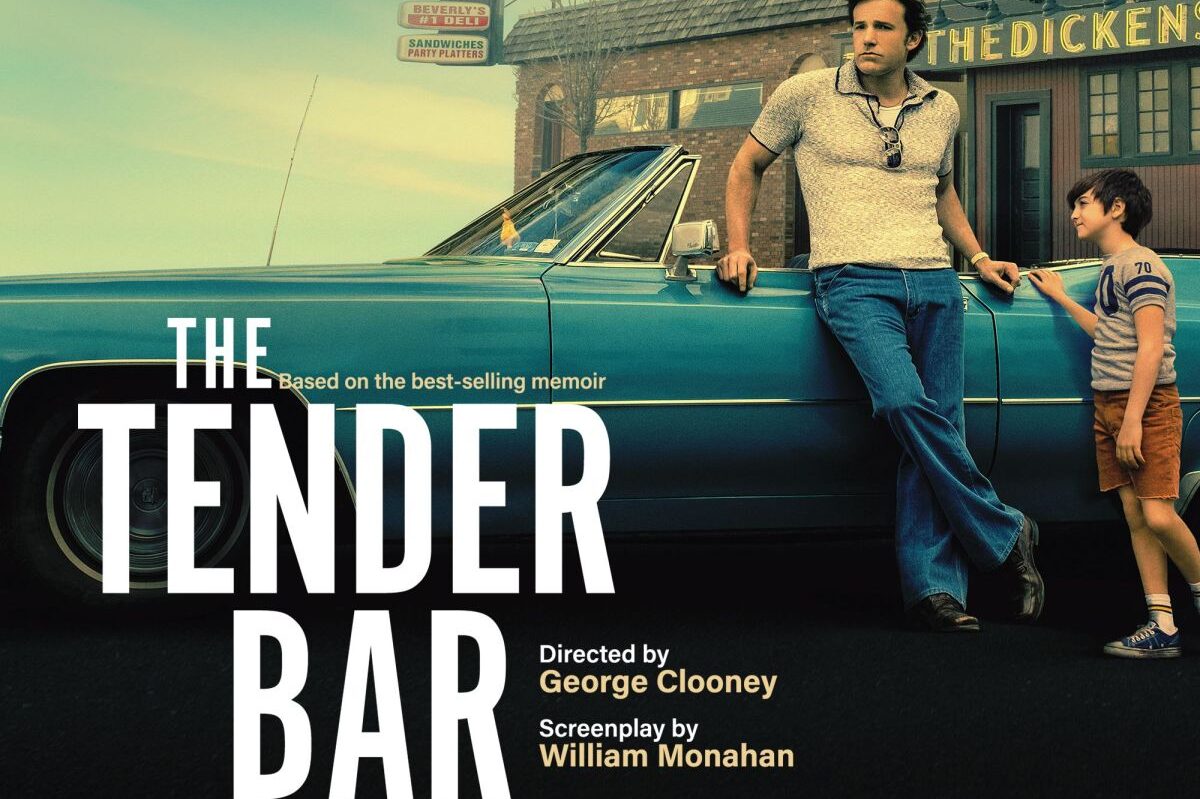

The Tender Bar

Watch Trailer

DEXTER

Watch Trailer

Joyner Lucas – Will (ADHD)

Watch Music Video

Castle Rock Season 2

Watch Trailer

Castle Rock Season 1

Watch Trailer

The Society

Watch Trailer

Defending Jacob Miniseries

Learn More

Daddy’s Home 2

Watch Trailer

The Possession of Hannah Grace

Watch Trailer

Central Intelligence

Watch Trailer

The Equalizer 2

Watch Trailer

Lexus LC 500 World Premiere

Watch Trailer

John and the Hole

Learn More

NE Baptist Commercial

Watch Commercial

Direct TV

Watch CommercialContact us